March 2024

Dear Friends,

In 2023, we again stepped up to challenge and finished the year in solid condition. Instability on the national banking scene – dramatized by the failures and regulatory takeovers of Silicon Valley Bank, Signature Bank, and First Republic Bank during the first half of the year – had ripple effects throughout the sector. Northfield Savings Bank responded by assuring customers of our strengths and by being proactive in providing multiple options for depositors to ensure balances were federally insured. In its efforts to contain and reduce inflation, the Federal Reserve continued to raise interest rates, with four additional hikes through July. The rapid escalation beginning in March 2022 resulted in a rise of 5.25% over a 16-month period. Rates at the shorter end of the yield curve exceeded those at the longer end, making it more expensive for households and enterprises to borrow money and for financial institutions of all sizes to fund their asset commitments with deposits and other sources. The effect was a drop in our net interest margin, the primary driver of net interest income and overall earnings. Despite these headwinds, NSB executed our strategic initiatives and fully met expectations of our customers and communities, highlighted by us earning for a second year running “Best Bank Statewide” in the annual Vermont Business Magazine “Best of Business” readership survey.

2023 Financial Summary

The company finished the year at $1.505 billion in assets, a 6.5% rise over the prior year. Net loans grew 7.1% to $1.031 billion. Deposits and other local funding declined less than 1% year-over-year, finishing at $1.268 billion. With a 0.46% year-over-year decline in net interest margin, earnings fell to $3.2 million. During the final quarter of the year, we were successful in exiting the defined benefit pension program by transitioning commitments to a reputable third party at a one-time plan withdrawal cost of $1.2 million. Equity capital rose 10.9% to $126.4 million. Tangible and regulatory equity ratios remain strong, as does overall asset quality.

Untamed Waters

Federal monetary policy was not the only force of consequence in 2023. Hydraulics kicked in July 10, devastating Montpelier, Barre, and other river towns in Vermont. We lost our State Street office in Montpelier (NSB’s largest) to flooding and were closed at our Barre Main Street office for a week. Our team and customers remained resilient as we got to work installing a temporary branch in the Capitol Plaza parking lot, opening in late August. In keeping with our commitment to downtowns throughout our service area, we have been under construction in our State Street space, building in some future remediation. We will move back in early spring.

Celebrating 20 Years in Chittenden County

In 2002, NSB opened a mortgage origination office in Williston. In September 2003, NSB’s first full-service branch office in Chittenden County was opened on Pearl Street in Essex Junction. It was soon followed by a new office on Shelburne Road in South Burlington. Then came Taft Corners Williston in 2004, College Street Burlington in 2005, and Williston Road South Burlington in 2006. In 2020, we added our commercial banking office at 210 College Street. In 2021, we expanded into Richmond to succeed TD Bank as the only bank in town. In June 2023, we completed our move into a permanent new home in the community on the corner of Pleasant Street and Bridge Street in the heart of the Village. In July 2023 we opened our beautiful new Marketplace Office on Church Street in Burlington, completing our move from the former branch on College Street. We had a lot to celebrate as we marked 20 years of bringing the best of community banking to Vermont’s largest county.

Enterprise24

Since our move beyond pandemic mode in mid-2021, we have been guided by our Enterprise24 strategic plan. All initiatives in four of the six themes noted in last year’s report were completed within the original 30-month plan window concluding December 31, 2023. Two themes – Enterprise Market Development and Information Technology Strategic Plan – were deemed by our Board worthy of extending 12 months through 2024 to allow several promising projects to be fully executed. We are methodically asserting ourselves as Vermont’s preeminent bank for enterprise. Our fortified value proposition is gaining new relationships as more and more businesses, firms, practices, non-profits, local governments, and institutions determine that Northfield Savings Bank delivers. On the technology front, we have been building a 21st century backbone for a decade, beginning with the opening of our state-of-art Operations Center in 2015. The work we will be completing in 2024 will realize the scale and efficiency that gives us parity with larger players. These two themes are vital to our return to the financial trajectory we had been enjoying prior to 2023 and the advancement of our 157-year-old independent mutual bank stature.

Conclusion

Norwich University president Edward Bourns, along with other leading citizens of the day, founded Northfield Savings Bank in 1867. The name has been embedded in granite ever since. An abiding commitment has been to providing Vermonters with a safe, reliable, and financially sensible partner for their banking needs. That commitment remains on display today. Another virtue of the institution throughout our history has been steady and prudent governance by talented and devoted Trustees. These past three years have brought tests and trials. Each one was faced with resolve and overcome. At the helm, demonstrating patience, skill, and a deep reservoir of experience making Vermont a better place, has been Board Chair Mary Alice McKenzie. Mary Alice will be handing Chair duties to incumbent Vice Chair John Lyon this spring. Trustee Nicole Carignan will be stepping up to Vice Chair. NSB is blessed to have leaders of such caliber and dedication to our company, customers, colleagues, and communities.

Our team members are outstanding professionals. We take nothing for granted. We all know we must show up each day to serve and to honor our core principles. Mattering to our stakeholders such that you wish to sustain your bonds with us motivates all that we build, make and do. Thank you for making it a privilege and joy.

Sincerely,

Thomas S. Leavitt

President & CEO

2023 Financial Overview

Balance Sheet

As of December 31 (Dollars in thousands)

ASSETS

Cash and Cash Equivalents

Investment Securities

Federal Home Loan Bank Stock

Residential Loans

Commercial Loans

Consumer Loans

Allowance for Credit Losses

Bank Premises and Equipment

Other Assets

Total Assets

$81,810

299,461

855

481,028

510,982

47,662

(8,533)

18,985

72,378

$1,504,628

LIABILITIES & CAPITAL

Deposits

Customer Repurchase Agreements

Borrowings

Other Liabilities

Equity Capital

Total Liabilities & Capital

$1,190,675

77,370

88,063

22,162

126,358

$1,504,628

Statement of Earnings

For Year Ended December 31 (Dollars in thousands)

Interest on Loans

Interest on Investments

Total Interest Income

Interest on Deposits

Interest on Borrowings

Total Interest Expense

Net Interest Income

Provision for Credit Losses

Other Operating Income

Operating Expenses

Earnings before Income Taxes

Income Taxes

Net Income

$42,985

7,167

50,152

10,250

4,534

14,784

$35,368

($500)

6,034

(37,660)

3,242

69

$3,173

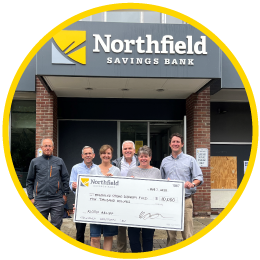

Committed to Community

As a mutual institution, we are committed to our customers and the communities where we live and work. Our major donations to local non-profits exemplify this commitment in action, supporting the Vermont communities we serve, year after year. In 2023, Northfield Savings Bank contributed $350,000 to more than 100 community organizations in Vermont.

ABA Foundation

Age Well

Aldrich Public Library

All Brains Belong VT

ALS Association

Alzheimer's Association

American Foundation for Suicide Prevention

American Heart Association

ANEW Place

Barre Community Flood Relief

Barre Opera House

Barre Rotary Foundation

Boys & Girls Club of Burlington

Brookfield Community Partnership

Burlington Business Association

Camp Ta-Kum-Ta

Camp Thorpe

Central VT Adult Basic Education

Central VT Council on Aging

Central Vermont Habitat for Humanity

Central VT Home Health & Hospice

Central VT Humane Society

Champlain Valley Office of Economic Opportunity

Charlotte Public Library

Committee on Temporary Shelter (COTS)

Common Roots

Community & Economic Development Office

Community Emergency Relief Volunteers (CERV)

Community Harvest of Central VT

Community Senior Center of Richmond

CSB Youth Hockey

Downstreet Housing and Community Development

Dragonheart Vermont

Eric Hutchins Memorial Scholarship

Family Center of Washington County

Feeding Chittenden

Freezing Fun for Families

Gifford Medical Center

Good Samaritan Haven

Governor's Institute of Vermont

Greater Burlington Multicultural Resource Center

Greater Burlington YMCA

Green Mountain Book Festival

Green Mountain Habitat for Humanity

Green Mountain Hounds

Green Mountain Mobile Therapy

Green Mountain Pug Rescue

Green Mountain United Way

Green Mountain Youth Symphony

Green Up Vermont

HomeShare Vermont

Howard Center

Humane Society of Chittenden County

Hunger Mountain Children's Center

Inclusive Arts Vermont

Intervale Center Inc

Jenna's Promise

Jewish Community of Greater Stowe

Joint Urban Ministry Program

Kellogg-Hubbard Library

KidSafe Vermont

King Street Center

Kingdom County Productions

Kitty Korner Cafe

Lake Dunmore Fern Lake Association

Lamoille Area Cancer Center

Lund

Mad River Valley Chamber of Commerce

Mad River Valley Rotary Club

Mayo Healthcare

McClure Miller Respite House

Med47 Foundation

Mentor Vermont

Mercy Connections

Middlesex Bandstand

Montpelier Alive

Montpelier Area Mountain Bike Association

Montpelier Strong Recovery Fund

Mosaic Vermont Inc

Music Composition Mentoring Program

Northfield Observances Inc

Northfield Senior Center

Norwich University

Opportunities Credit Union

Our Community Cares Camp

Outright Vermont

Pan Mass Challenge Cancer Ride

Partnership for Literacy

Pittsfield Fire Department

Potter's Angels Rescue

Randolph Rotary Club

Randolph Singers

Rebuilding Together Greater Burlington

Recovery Partners of Vermont

Revitalizing Waterbury

Richmond Historical Society

Richmond Land Trust

Rotary Club of Waterbury

Sail Beyond Cancer Vermont

SCORE Vermont

Shelburne Little League

Shidaa Projects Inc

Silver Towers Camp

South Burlington Library Foundation

South Burlington Rotary Club

Special Olympics Vermont

Spectrum Youth and Family Services

Starbase Vermont Inc

Steps To End Domestic Violence

Stern Center for Language

Stowe Theater Guild

Studio Place Arts

Susan G Komen

Take Me Back Inc

Technology for Tomorrow

The Curtis Fund

The Growing Peace Project of Milestone Adventures

The People's Farmstand

Town of Warren

Turning Point Center of Chittenden County

Twin Valley Senior Center

Vermont Afterschool Inc

Vermont Association for the Blind and Visually Impaired

Vermont Chamber Foundation / Vermont Futures Project

Vermont Children's Trust Foundation

Vermont Council on Rural Development

Vermont Family Network

Vermont Foodbank

Vermont Historical Society

Vermont Italian Cultural Association

Vermont Jump$tart Coalition

Vermont Kidney Association

Vermont Land Trust

Vermont Racial Justice Alliance

Vermont Sports Hall of Fame

Vermont Women's Fund

Vermont Works for Women

Waterbury Ambulance Service

Waterbury Fire Department

Wood4Good LTD

Yestermorrow

Youth First Mentoring

Leadership

Northfield Mutual Holding Company

Directors

John T. Burke

Nicole M. Carignan

Kyle Dodson

Brian Eagan

Jon Jamieson

Thomas S. Leavitt

John Lyon - Vice Chair

Mary Alice McKenzie - Chair

Thomas Robbins

Mark Saba

Kerin Stackpole

Officers

Thomas S. Leavitt

President

Cory B. Richardson

Treasurer

Amy Turosak

Corporate Secretary

Corporators

Indra J. Acharya

Belan Antensaye

Kim Bolduc

John T. Burke

Lilli Cain

Nicole M. Carignan

Laura Carlsmith

H. Wright Caswell

Stephanie T. Clarke

Edward Corrigan

Michael C. Diender

Kyle Dodson

Dr. Nadia A. DuBose

Brian Eagan

Ted Elzey

Jennifer Emens-Butler

Dolly Fleming

Yael Friedman

Karen Galfetti Zecchinelli

John Grenier

John J. Handy

Jeffrey Harkness

Brian Harwood

Katie Hawley

Wanda Heading-Grant

Jon Jamieson

Scott Johnstone

Fletcher Brian Joslin

Lisa L. Keysar

Travis J. Kingsbury

Susan M. Klein

Rob Korrow

Jeff LaBonte

Mike Lajeunesse

Jeffrey Larkin

Sean Lawson

Thomas S. Leavitt

Kevin Lord

Steven Loyer

John Lyon

Owiso Makuku

Mary Alice McKenzie

Sue Minter

Eva M. Morse

Allyson Myers

Bob Nelson

Jeffrey Nick

Chris Noyes

W. Dan Noyes

Adam Osha

Nancy Owens

Marissa Parisi

Keith Paxman

Deborah A. Phillips

Roberto J. Pierre

Dave Pocius

Nancy Pope

Sarah Richards

Thomas Robbins

Sandy Rousse

Mark Saba

Leslie Sanborn

Liz Schlegel

RADM Richard Schneider USCGR (Ret)

Matt Schrag

Steven Shea

Heather F. Shouldice

Kerin Stackpole

Frances Stoddard

Philip T. Sussman

Wallace W. Tapia

David J. Whaley

James H. Wick

Lauren D. Wobby

Nancy F. Zorn

Northfield Savings Bank

Officers

Charles H. Abare

Consumer Credit Processing Manager

Samantha E. Abare

Mortgage Banking Officer

Madeline K. Andrews

Senior Community Banking Officer

Donna A. Austin-Hawley

EVP & Chief Human Resources Officer

Chad A. Bell

VP Investment Consultant Manager

Clay E. Bell

VP Investment Consultant

Daniel K. Boylan

Risk Management Officer

Lori A. Bussiere

Deposit Operations Manager

Alyson K. Campbell

Marketing & Communications Manager

Timothy K. Carpenter

VP Commercial Banking

Megan L. Cicio

SVP Enterprise & Government Banking

Michele D. Crochiere

Community Banking Officer

James V. Dattilio

Community Banking Officer

Tracy L. Davis

Senior Community Banking Officer

Bradford S. Doane

VP Project Manager

Sherry L. Doane

VP Operations

Alfred J. Flory

EVP & Chief Lending Officer

Benjamin T. George

VP Commercial Banking

David A. George

IT Core Operations Manager

Donna M. Gerdes

Collections Manager

Mary E. Gleason

Senior Community Banking Officer

Christopher Jarvis

VP Commercial Banking

Mark J. Kalloz

Community Banking Officer

Timothy P. Kane

VP Compliance Officer

Wendy C. Kellett

Senior Community Banking Officer

Kerry Keown

Community Banking Officer

Debra L. Kerin

VP Community Banking

Kathleen M. LaCross

VP Enterprise & Government Banking

Cheryl A. LaFrance

EVP & Chief Operating Officer

Maryellen LaPerle

VP Mortgage Banking

Krystal L. LaRose

Mortgage Banking Officer

Thomas S. Leavitt

President & CEO

Keith A. Letourneau

Community Banking Officer

Stephanie E. MacAskill

VP Direct Banking & Deposit Operations

Christine E. Martin

Bank Secrecy Act Officer

Del’Rae LM Merrill

Community Banking Officer

Melissa A. Neun

SVP Risk Management

Kristin L. O’Connor

VP Human Resources

Robert F. O’Neill

Security Officer

Heather M. Parizo

Community Banking Officer

Jason J. Pidgeon

VP Mortgage Banking & Consumer Credit

Roger P. Pinan

Mortgage Banking Officer

Wright C. Preston

SVP Commercial Banking

John P. Ravaschiere

VP Commercial Banking

Wendy S. Rea

Senior Community Banking Officer

Cory B. Richardson

EVP & Chief Financial Officer & Chief Credit Officer

Gina R. Sargent

Consumer Credit Manager

Timothy D. Sargent

SVP Information Technology

David W. Seaver

VP Commercial Banking

Kellie J. Stefaniak

Loan Operations Manager

J. Billy St. Louis

Commercial Banking Officer

Edward T. Sulva

SVP Controller

Julie L. Therrien

Financial Operations Officer

Amy M. Turosak

Corporate Secretary

Robert B. Wheeler

SVP Commercial Credit

Rosemarie A. White

SVP Commercial Banking

Marsha D. Wimble

VP Commercial Banking

Andrea L. Wolak

VP Enterprise & Government Banking Services